1040 Form 2024 Schedule C – Once the IB ACIO Application Form 2024 is released, aspiring candidates can initiate the registration process by visiting the official website at mha.gov.in. The IB ACIO registration process . Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2024, the standard deduction for single taxpayers and married couples filing separately is $14,600. .

1040 Form 2024 Schedule C

Source : carta.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

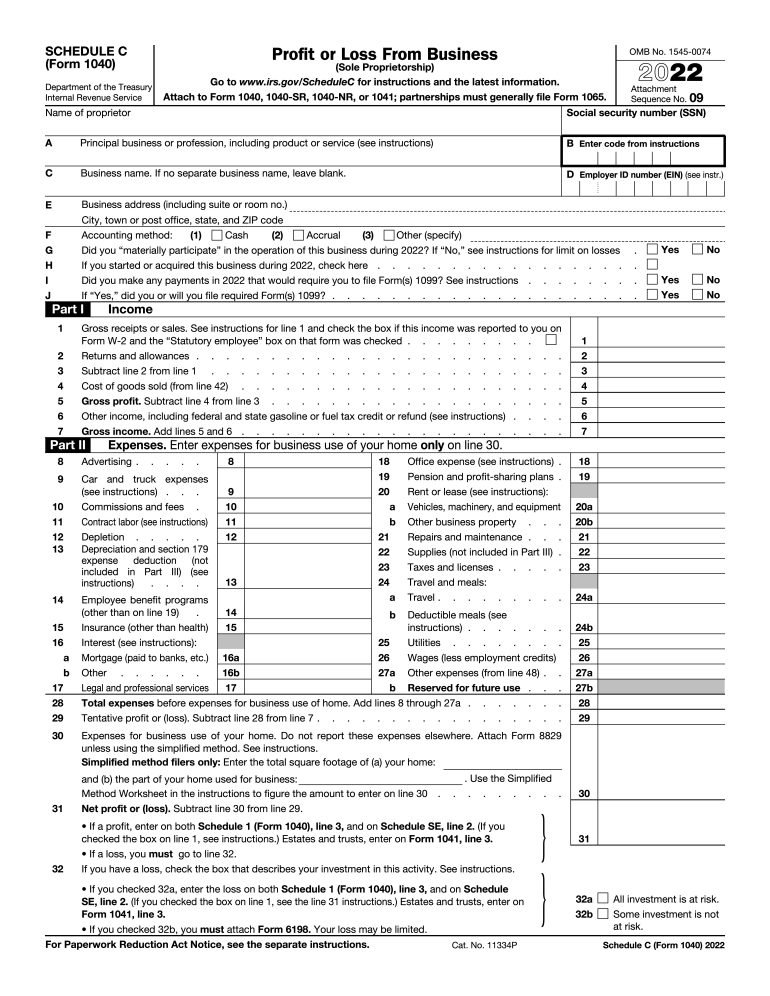

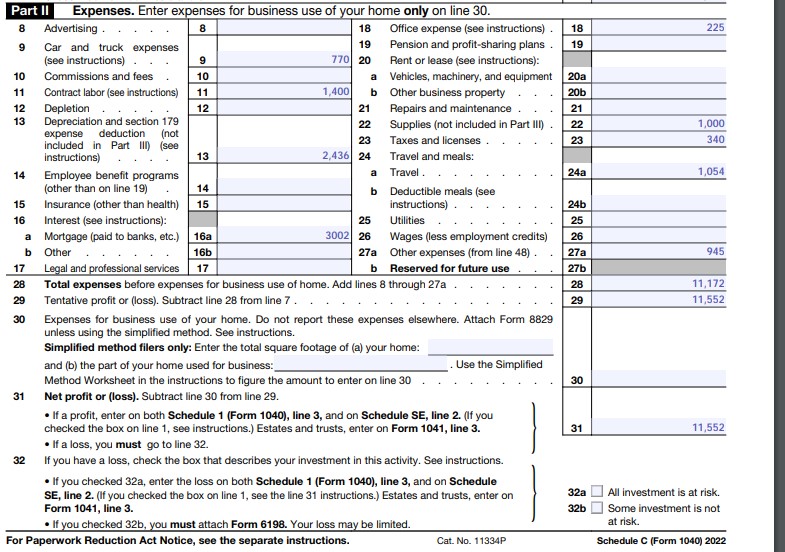

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Schedule C Profit or Loss for Form 1040

Source : www.appypie.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

Tax Guide for Small by U.S. Department of the Treasury

Source : www.amazon.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

1,397 Schedule C Images, Stock Photos, 3D objects, & Vectors

Source : www.shutterstock.com

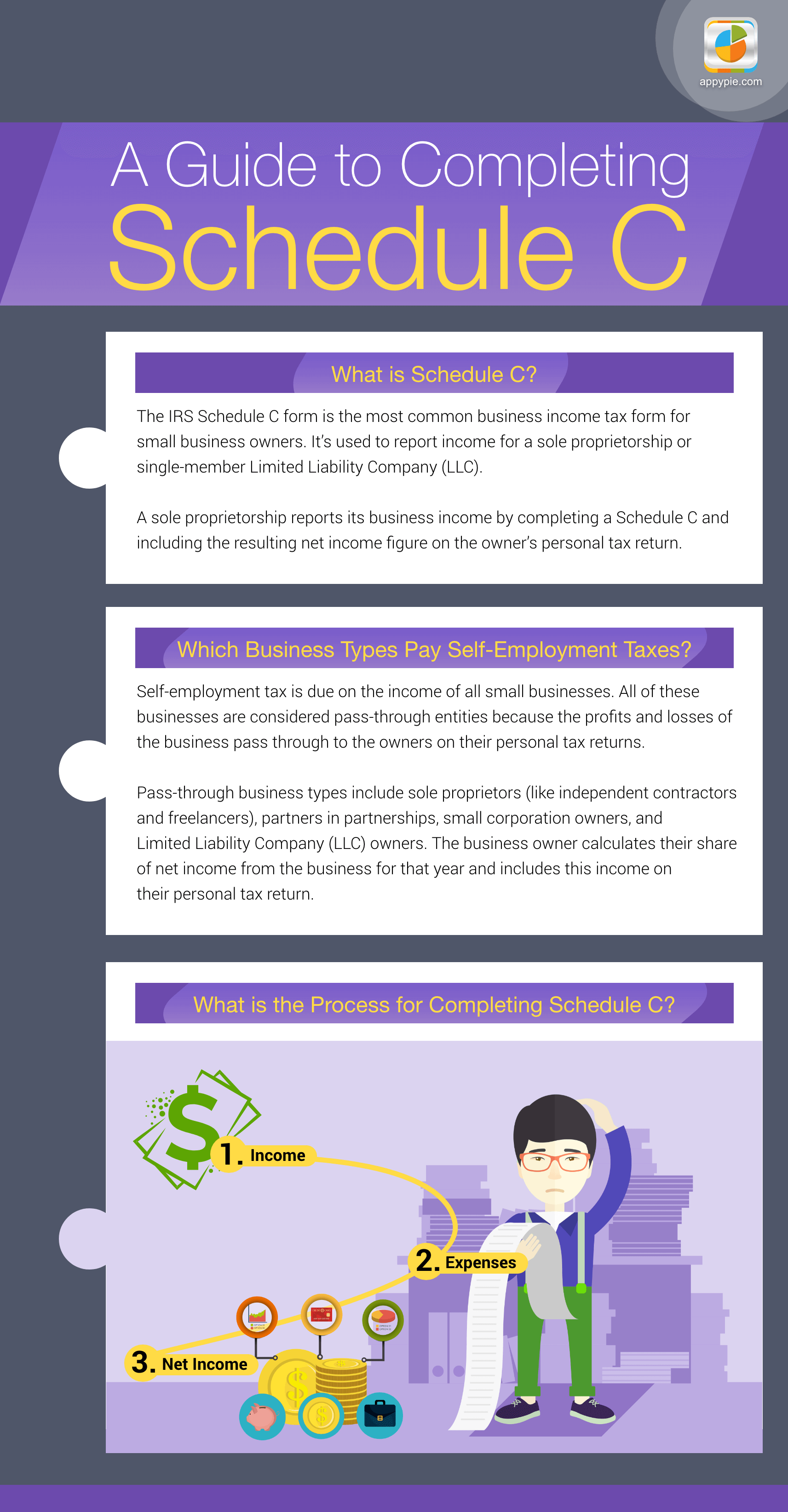

1040 Form 2024 Schedule C Business tax deadlines 2024: Corporations and LLCs | Carta: Schedule C is a form that self-employed people have to file alongside their tax return, or Form 1040. “The difference between Form W-2 and Schedule C is that the W-2 is for wages earned at a job. . Note that the provided schedule is approximate, and changes may occur. Any modifications will be promptly communicated through the Commission’s website. Regular updates regarding the estimated .